Health

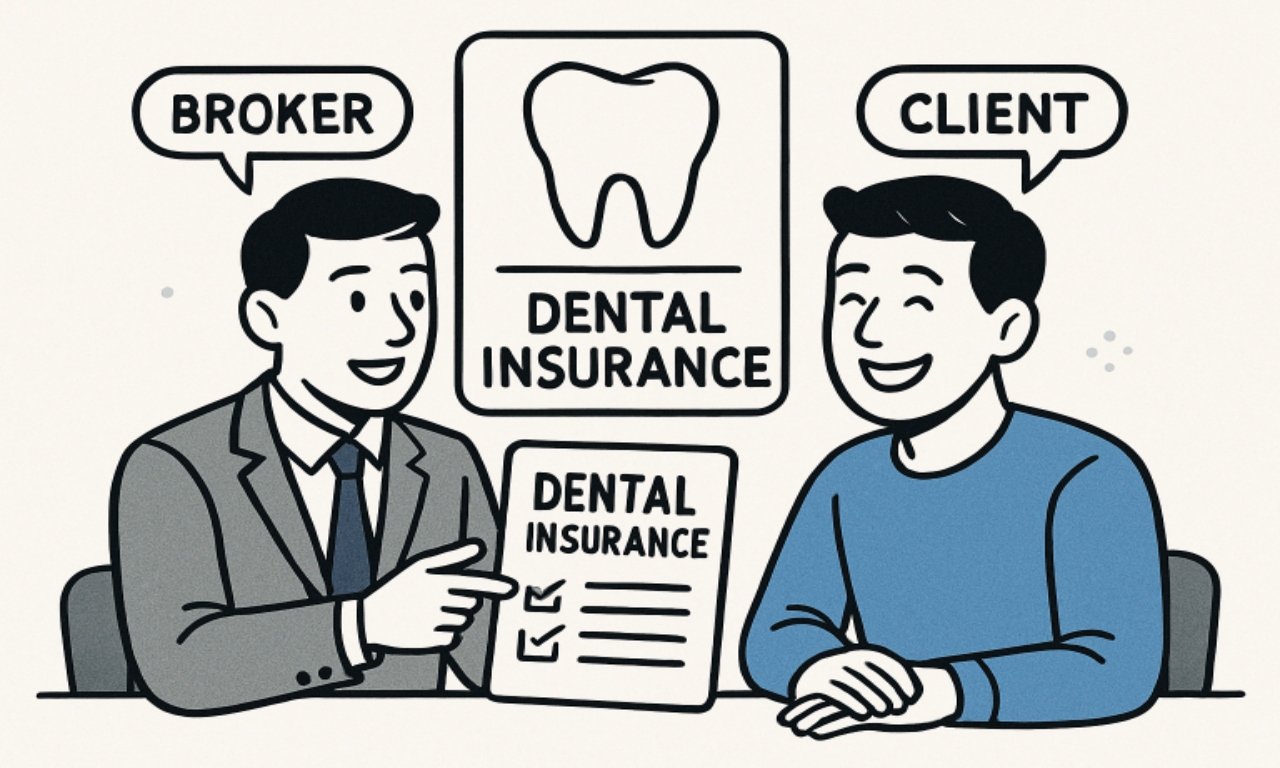

Top Tips for Brokers Selling Dental Insurance Plans

Introduction

As health coverage becomes increasingly comprehensive, brokers who expand their portfolios to include dental insurance are securing essential revenue streams and responding to a notable rise in consumer demand. In a rapidly evolving market, understanding how to sell dental insurance through Delta Dental can position brokers ahead of the curve, especially as more clients seek options with robust health and dental benefits.

Offering dental insurance is advantageous in terms of business growth and helps fulfill a critical need for clients facing the recent loss of Medicaid dental benefits. Building trust and matching the right plan to each individual’s situation is vital for long-term success in this competitive market.

Education and transparency remain at the forefront of successful sales strategies. By equipping clients with the knowledge to make informed choices, brokers strengthen relationships and foster repeat business, setting themselves apart in a crowded marketplace.

Staying well-versed in the latest industry trends, regulations, and customer preferences enables brokers to adapt quickly, keeping offerings relevant and valuable. Brokers who consistently refine their approach using data and feedback will be well-positioned for sustainable growth.

Understand the Market Demand

The landscape of dental insurance is shifting, particularly as millions of Americans lose dental coverage through Medicaid due to recent policy changes. This emerging gap is a profound opportunity for brokers, as clients seek private dental plans to compensate for lost benefits. Understanding this market evolution and staying informed about local and national policies allows brokers to approach potential clients with timely solutions that address urgent concerns. According to a recent report from the Kaiser Family Foundation, this policy-driven demand highlights the need for brokers who can act quickly to provide alternative dental coverage.

Educate Clients on the Importance of Dental Coverage

Many clients are unaware of the critical link between oral health and overall well-being. Educating clients about the benefits of preventive dental care—such as reduced risks for heart disease, diabetes, and other serious health issues—helps illustrate the value of dental insurance well beyond basic oral care. Providing clients with evidence from reputable resources, such as the Centers for Disease Control and Prevention (CDC), supports informed decision-making and builds credibility for the broker.

Offer Solutions

No two clients share the same insurance needs, making it essential for brokers to provide flexible options and adapt coverage to each individual relationship. Brokers who take the time to analyze a client’s specific requirements, whether for an individual or a small business, develop higher-value proposals. For example, small businesses may be focused on affordability and simplicity, while families might require greater flexibility or expanded coverage for children.

Leverage Technology

Embracing digital solutions puts brokers ahead of the competition. By integrating Customer Relationship Management (CRM) software, brokers streamline client communication, track interactions, and efficiently manage follow-ups. Online quoting tools deliver quick insurance estimates and help showcase professionalism and responsiveness. This technology-driven workflow improves customer satisfaction and operational efficiency.

Stay Informed About Industry Trends

The dental insurance market continues to evolve, requiring brokers to remain alert and informed. Keeping pace with regulatory updates, new coverage models, and shifting market trends allows them to provide clients with forward-looking advice and competitive solutions. Brokers gain valuable insights that enhance their expertise by actively subscribing to industry publications, joining webinars, and engaging in professional networks. This commitment to ongoing learning strengthens client trust. It sharpens sales strategies, ensuring they remain relevant in a competitive environment—consistent knowledge-building positions brokers as reliable partners who deliver meaningful value and long-term guidance.

Build Trust Through Transparency

Open communication is vital when addressing dental insurance plans, as it ensures clarity and builds confidence between providers and clients. By thoroughly explaining key policy features—such as deductibles, copayments, and annual maximums—employers and insurers help individuals make informed decisions about their coverage. This level of detail eliminates confusion about what services are included and which may require out-of-pocket expenses. When people clearly understand their benefits, they are more likely to use them effectively and feel satisfied with the support they receive. Transparency not only strengthens trust but also minimizes the risk of future frustration, disputes, or cancellations, creating a smoother, more reliable experience for both employees and organizations alike.

Highlight Cost Savings

Dental insurance is vital in promoting consistent, preventive care that helps individuals maintain better oral health over time. Encouraging routine checkups and cleanings supports early detection of potential issues, which can be addressed before they progress into costly, complex treatments. This proactive approach protects overall health and significantly reduces the financial burden of major dental procedures. Showing clients the long-term savings and stability dental coverage provides reinforces the value of enrolling now, rather than delaying and facing unexpected emergencies with much higher out-of-pocket expenses that could strain their budget.

Utilize Effective Marketing Strategies

Growing a client base demands a proactive and consistent marketing strategy beyond traditional methods. Leveraging social media platforms allows brokers to showcase expertise, engage directly with potential clients, and build real-time brand visibility. Targeted email campaigns provide a way to nurture relationships and inform prospects about valuable offerings. Publishing educational blog content further positions brokers as trusted resources while improving search engine visibility. Beyond digital efforts, engaging with local organizations and attending community health fairs or hosting webinars creates face-to-face connections, fosters trust, and generates high-quality leads. Together, these efforts strengthen credibility, expand outreach, and establish a strong presence in both online and offline markets.

Conclusion

The world of dental insurance sales is rich with opportunity, particularly for brokers willing to embrace change, educate their clients, and leverage every tool for success. Detailed knowledge of market needs, proactive adaptation to industry trends, and transparent service delivery differentiate top brokers in today’s competitive landscape. By incorporating these strategies and continually refining their approach, brokers can grow their portfolios, strengthen client satisfaction, and thrive—even as the market evolves.

Music8 months ago

Music8 months ago[Album] 安室奈美恵 – Finally (2017.11.08/MP3+Flac/RAR)

Music8 months ago

Music8 months ago[Album] 小田和正 – 自己ベスト-2 (2007.11.28/MP3/RAR)

- Music8 months ago

[Single] tuki. – 晩餐歌 (2023.09.29/Flac/RAR)

- Music8 months ago

[Album] back number – ユーモア (2023.01.17/MP3/RAR)

Music8 months ago

Music8 months ago[Album] 米津玄師 – Lost Corner (2024.08.21/MP3 + Flac/RAR)

- Music8 months ago

[Single] ヨルシカ – 晴る (2024.01.05/MP3 + Hi-Res FLAC/RAR)

Music8 months ago

Music8 months ago[Album] ぼっち・ざ・ろっく!: 結束バンド – 結束バンド (2022.12.25/MP3/RAR)

Music8 months ago

Music8 months ago[Album] Taylor Swift – The Best (MP3 + FLAC/RAR)