Finance

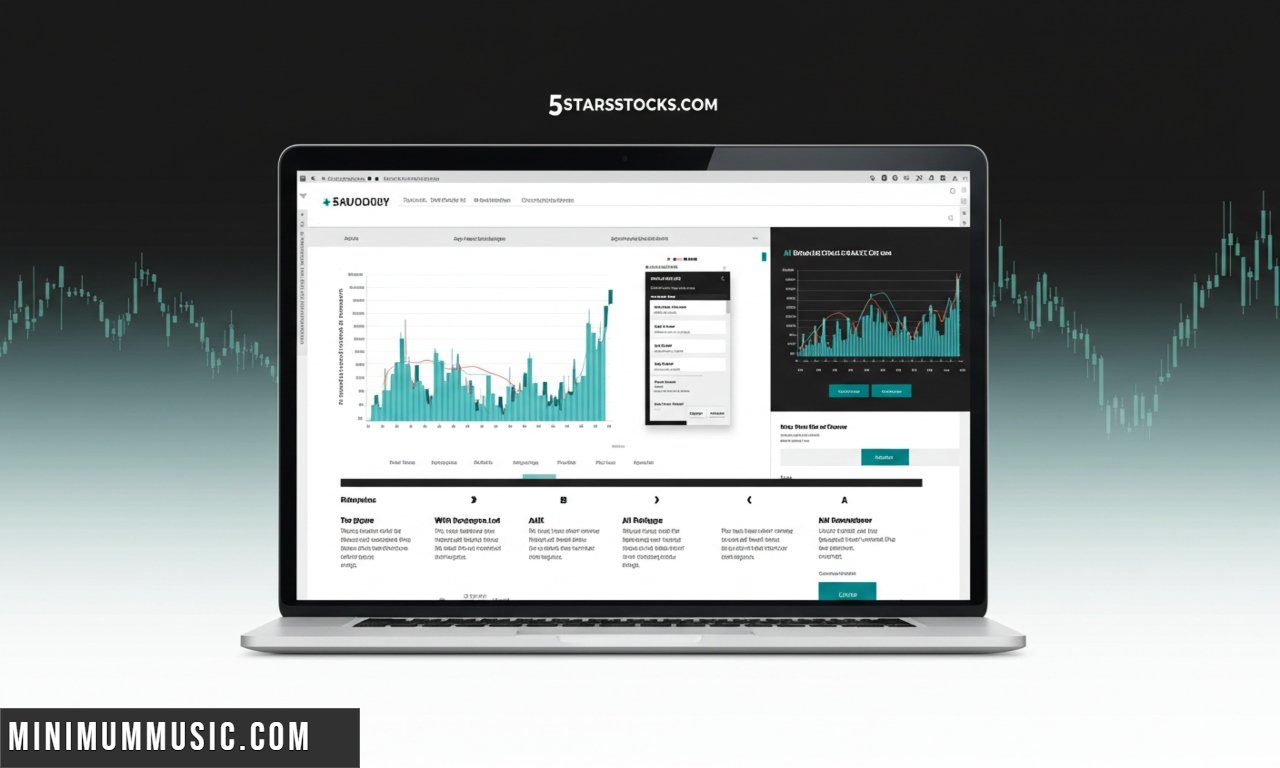

5starsstocks.com ai: Revolutionizing Stock Market Intelligence

In today’s fast-paced world of finance, 5starsstocks.com ai emerges as a prominent name. It combines artificial intelligence, data analytics, and predictive modeling to help traders and investors make smarter decisions. In this article, we’ll dive deep into what 5starsstocks.com ai is, how it works, its benefits, challenges, use cases, and future outlook.

Introduction

When the stock market fluctuates by the minute, having an edge becomes crucial. That’s exactly where 5starsstocks.com ai claims to step in. Leveraging advanced algorithms, machine learning, and real-time data, it promises to deliver insights that few human analysts can match. Yet, as with any innovation, questions linger: How reliable is it? What are the risks? Can it outperform human judgment? Over the next several sections, we’ll unpack everything you need to know about 5starsstocks.com ai — how it operates, its real value, its limitations, and best practices if you decide to adopt it.

What Is 5starsstocks.com ai?

5starsstocks.com ai is a platform built around artificial intelligence and quantitative analysis. It ingests vast quantities of market data — stock prices, volume, news, social sentiment, macroeconomic indicators — and applies various AI models to generate predictions, alerts, and actionable signals. The core idea is to assist users — from retail traders to institutional investors — in making more informed decisions in stock selection, timing, and risk control.

You Might Also Like: Crypto 30x.com

It is not purely “black box” — according to its promotional materials, users can view model confidence levels, factor contributions, and backtesting results. Thus, it aims to bridge data science and practical trading.

Why It Matters

In a world drowning in data, the challenge is not lack of information, but making sense of it. Traditional analysis methods (fundamental analysis, technical charts, manual modeling) can’t always keep up with fast market movements, global events, and social media chatter. That’s where 5starsstocks.com ai steps in: it ingests, processes, and synthesizes more data faster than any individual could.

Moreover, it reduces emotional bias. Many investors are swayed by fear, greed, or headlines. An AI system, ideally, remains dispassionate — it reacts based solely on data and model logic (though model design and training choices bring in human bias). For those seeking a systematic approach, 5starsstocks.com ai offers a calibrated, data-driven companion.

Core Components: Behind the Scenes

To understand 5starsstocks.com ai, let’s break down its core technical components:

Data Collection & Integration

It gathers data from multiple sources: exchange feeds, news APIs, social media, macroeconomic databases, corporate filings. The more diversity of data, the richer the models.

Feature Engineering

Raw data is often noisy or meaningless in isolation. The system builds “features” — derived variables like moving averages, volatility metrics, sentiment scores, factor exposures (value, momentum, quality), correlations, event flags.

Model Design & Training

Using machine learning — regression, classification, neural networks, ensemble methods — the system is trained on historical data to recognize patterns that preceded price moves. Cross-validation, walk-forward testing, regularization, and feature selection help avoid overfitting.

Signal Generation & Scoring

Once trained, the model applies to live data and outputs signals: buy, hold, sell, with strength scores and confidence metrics. It may produce sector rankings, top picks, risk assessments.

Backtesting & Validation

Any credible AI platform must show how its signals would have performed historically. Ideally, this includes various market regimes (bull, bear, volatile, calm periods) and incorporates transaction costs and slippage.

User Interface & Alerts

The front end displays charts, dashboards, signal summaries, and alerts (via email, SMS, app). Users can set thresholds or filters (e.g. only show signals above 80% confidence).

Risk Management Layer

Good systems include position sizing rules, stop-loss suggestions, diversification checks, drawdown monitoring, and scenario stress tests.

Key Features & Offerings

Here are typical features that 5starsstocks.com ai might (or does) provide to its users:

- Top Picks & Watchlists based on AI scoring

- Sector & Subsector Rotation Signals

- Sentiment Analytics (news, social media)

- Factor Exposure Reports (value, momentum, size, quality, volatility)

- Backtest Reports & Historical Performance

- Confidence & Probability Scores for each signal

- Custom Alerts & Notifications

- Portfolio Simulator / Paper Trading integration

- Risk Controls & Capital Allocation Suggestions

- Educational Tools & Explanations of AI Models

These features help users not only see the “what” but also understand the “why” (to some extent) behind each prediction.

Benefits & Strengths

Using 5starsstocks.com ai offers several potential advantages:

Speed & Scalability

AI can process enormous volumes of data instantly. It can scan thousands of stocks, many data sources, and reagent on events far faster than humans.

Systematic, Disciplined Approach

By following model signals, users reduce emotional, impulsive trades. Discipline is baked in.

Objective, Data-Driven Insights

Models rely on patterns learned from real data, not gut feel alone. Combined with transparency (signal strength, factor contributions), users can better trust or question suggestions.

Continuous Learning & Adaptation

Modern AI models can retrain or update continuously as new data flows in, adapting to regime changes.

Supplemental Tool, Not Replacement

A savvy investor can use 5starsstocks.com ai as a complement — feeding ideas, alerts, confirmations — while still applying human judgment.

Risks, Limitations & Challenges

No system is perfect. Here are important caveats for 5starsstocks.com ai:

Overfitting & Survivorship Bias

Models may inadvertently learn noise rather than true signals. If backtests only focus on “survivor” stocks, they may appear better than in reality.

Black-Box Behavior & Explainability

Complex AI models (like deep neural networks) can be opaque. Even with confidence scores, fully understanding why a model chooses a stock is challenging.

Data Quality & Latency

If input data is incorrect, delayed, or manipulated, outputs will suffer. Garbage in, garbage out.

Regime Shifts & Unexpected Events

AI models trained on past data may fail when new, unprecedented events occur (e.g. pandemic, geopolitical shock). The model may misjudge market reactions.

Transaction Costs, Slippage & Liquidity

Even if signals predict direction correctly, real trading involves costs, delays, and capital constraints, which may erode returns.

Overreliance or Automation Risks

Users may blindly follow signals and ignore their own due diligence. Or automated execution without oversight may exacerbate losses.

Psychological Discomfort

Trusting a machine’s decisions, especially when contrary to one’s intuition, can be psychologically difficult.

How to Use 5starsstocks.com ai Wisely

To get the most from 5starsstocks.com ai, consider these best practices:

Start with Paper Trading

Before risking real capital, test signals in a simulated environment. Observe real outcomes relative to model expectations.

Use Signals as Ideas, Not Commands

Don’t treat predictions as absolute mandates. Combine AI signals with your own research, judgment, and context.

Diversify

Even the best picks can fail. Spread exposure across sectors, styles, and risk levels.

Monitor Model Behavior

Keep an eye on drawdowns, recent performance, consistency, and whether signal strength correlates with outcomes.

Limit Allocations

Don’t overcommit to any single signal or set of signals. Use position sizing rules and risk caps.

Stay Educated

Understanding basic model mechanics, financial factors, and market behavior helps interpret signals wisely.

Reassess Periodically

Markets evolve. The model’s assumptions and performance should be reviewed and updated or replaced when necessary.

Use Cases & Real-World Applications

Let’s imagine some scenarios where 5starsstocks.com ai can shine:

Retail Trader

A trader juggling multiple stocks can use AI signals to prioritize which ones to dive deeper into. If the AI flags a handful of high-confidence picks each week, that saves time and focus.

Quantitative Hedge Fund

An institutional fund may integrate 5starsstocks.com ai outputs into their larger multi-factor framework, using AI scores as one input among many.

Advisory Firms / Analysts

Financial advisors or research teams may use AI outputs to augment their fundamental recommendations, spotting opportunities or risks they might miss.

Swing / Momentum Traders

For those trading on short to medium horizons (days to weeks), AI models built to detect momentum shifts or sentiment changes may provide edge.

Long-Term Investors

Though many AI systems focus on short-term signals, some models also forecast medium to long-term trends, helping investors in sector rotation, value cycles, or structural shifts.

Performance Metrics & Evaluation

To assess how well 5starsstocks.com ai is doing, one must look at transparent metrics. Some key ones include:

Metric | Description | Why It Matters |

| Annualized Return / CAGR | Compound average return | Ultimate benchmark of success |

| Sharpe Ratio / Sortino Ratio | Return per unit of risk | Helps compare risk-adjusted performance |

| Max Drawdown | Largest peak-to-trough loss | Gauges downside risk |

| Win Rate / Hit Ratio | Percentage of correct trades | Shows predictive accuracy |

| Average Gain / Loss Ratio | Size of wins vs losses | Helps assess asymmetry |

| Signal Correlation & Stability | How stable picks are over time | Helps detect noise / inconsistency |

| Backtest vs Live Performance Gap | Measure of model realism | Highlights overfitting or unrealistic assumptions |

A trustworthy system will present these metrics openly, with disclaimers, and allow users to dig into signal details.

Example Walkthrough: A Hypothetical Signal

Suppose 5starsstocks.com ai issues a “Strong Buy” signal on Stock ABC with 92% confidence. The associated data shows:

- Recent sentiment turned positive after good earnings.

- Momentum factor trending upward.

- Value factor becoming favorable (valuation cheaper relative to peers).

- Volatility moderate, liquidity strong.

As a user, you might:

- Check fundamentals: Is ABC’s financial health solid?

- Inspect recent news: Any surprises, announcements, or risks?

- Observe technical chart: Does price confirm the model signal?

- Allocate a small starter position (e.g. 1-2% of portfolio).

- Set a stop-loss or risk level.

- Monitor outcomes and compare with model’s confidence.

This hybrid approach combines AI insight with human oversight.

Common Misconceptions

It’s worth dispelling some myths around 5starsstocks.com ai:

- “AI guarantees profits.” No tool can guarantee. Markets are unpredictable; models can be wrong.

- “More signals means better.” Flooding you with low-confidence signals often adds noise.

- “You can set and forget.” Markets change — you must supervise.

- “AI replaces human intuition.” Rather, it complements human decision-making.

Recognizing these helps you maintain realistic expectations.

Comparing with Competitors

5starsstocks.com ai doesn’t exist in a vacuum. There are many AI or quant platforms in finance. What might distinguish it:

- Transparency: It may show confidence scores, factor contributions, backtests (some competitors don’t).

- Breadth of data: If it uses social media sentiment, news, macro data more comprehensively, it gains an edge.

- User interface & alerts: A clean, customizable dashboard and robust alert system matter.

- Cost structure: Subscription fee, tiering, performance fees—affordability can be a differentiator.

- Community & support: Educational content, user forums, analyst commentary strengthen user trust.

If you compare 5starsstocks.com ai with other quant platforms, evaluate along these axes.

Ethical, Legal & Compliance Considerations

Operating in financial markets with AI has responsibilities:

- Transparency & disclaimers: Users must understand risks and limitations.

- Data licensing compliance: Ensure data sources are legally used.

- Regulatory compliance: Depending on jurisdiction, AI recommendations might fall under financial advisory rules.

- Avoiding market manipulation: Systems must not be used to manipulate sentiment or markets unfairly.

- Bias mitigation: Models should be audited for unwanted biases (e.g., favoring certain sectors unfairly).

A responsible platform balances innovation with legal and ethical guardrails.

Future Trends & Evolution

The journey of 5starsstocks.com ai is just beginning. Some future directions might be:

- Explainable AI (XAI): More transparency in model reasoning.

- Hybrid models (AI + human): Combining expert judgments and ML models.

- Adaptive models: Self-evolving systems that detect regime shifts automatically.

- Alternative data expansion: Satellite imagery, geolocation, web scraping, IoT signals.

- Quantified sentiment & voice: Voice recognition sentiment (earnings calls) and video news analysis.

- Integration with execution systems: Auto-trading modules tied directly to AI signals.

- Personalized AI models: Tailoring algorithms to user risk tolerance, trading style, capital.

As innovation accelerates, 5starsstocks.com ai or similar systems may reshape how we invest.

Realistic Expectations & Users’ Mindset

When engaging with 5starsstocks.com ai, your mindset matters:

- Accept that losses will occur; no model is perfect.

- Use a long-term lens: evaluate over months, not days.

- Be ready to adapt: markets evolve, so should your approach.

- Stay skeptical: examine whether the AI’s output makes sense before diving in.

- Persist in learning: understanding the basics of quantitative finance helps contextualize AI signals.

A balanced, curious, cautious mindset will extract maximum benefit.

Steps to Start with 5starsstocks.com ai

If you decide to try 5starsstocks.com ai, here’s a suggested onboarding path:

- Read all documentation on methodology, disclaimers, performance.

- Start a trial or demo account, if available.

- Link a paper trading account to test real-time signals.

- Set small allocations initially, e.g. 5–10% of capital.

- Track performance vs benchmark (e.g. index).

- Review signal accuracy over several cycles.

- Adapt your rules (position sizing, stop losses) based on observed reliability.

- If comfortable, scale gradually, but maintain oversight.

Case Study (Hypothetical)

Imagine a user “Sara,” a part-time trader. She subscribes to 5starsstocks.com ai, and over three months:

- The AI flagged 10 stocks with “Strong Buy” signals.

- Out of those, 7 performed positively after two weeks, 3 declined.

- Her win rate: 70%. Average gain: +6%; average loss: –3%.

- Her portfolio beat the benchmark by 4% net of fees.

- She reinforced her confidence but also noticed that signals during volatile days were less reliable.

- She began filtering signals by higher confidence thresholds and combining with technical confirmation.

Though hypothetical, this underscores real challenges and opportunities of 5starsstocks.com ai in action.

Challenges You May Face

Using 5starsstocks.com ai may bring practical challenges:

- Signal overload or “paralysis by choice”

- Conflicts when AI contradicts your analysis

- Platform downtime or data feed outages

- Fee vs benefit calculation (is subscription worth cost?)

- Psychological stress when following algorithmic signals you don’t fully understand

Facing these is part of the learning curve. Document your experience, refine your rules, and iterate.

Tips for Maximizing Value

Here are some practical tips to squeeze more value from 5starsstocks.com ai:

- Use signal thresholds: only act on top 10–20% signals

- Combine AI signals with other strategies (fundamental screening, chart patterns)

- Use stop-loss and take-profit orders automatically

- Monitor rolling performance (e.g. last 30, 60, 90 days)

- Keep a journal: track where your actions diverged from AI and outcomes

- Join communities or forums (if available) to share insights

- Use AI’s feedback for reverse engineering your own strategies

Does 5starsstocks.com ai Work?

The critical question: can 5starsstocks.com ai work in practice? Based on general experience with AI in finance:

- In many cases, well-designed AI systems add incremental edge, especially when combined with human oversight.

- The best systems don’t outperform always but generate more good signals than bad, with proper risk controls.

- The gap between backtest and live performance is where the real test lies. Real trading friction, slippage, and data latency matter.

- Success often depends more on how the user uses the tool than the tool itself.

Thus, 5starsstocks.com ai can work — especially if you treat it as an assistant rather than an oracle.

Conclusion

5starsstocks.com ai represents a compelling intersection of artificial intelligence and financial market insight. When used thoughtfully, it offers speed, data-driven decision support, and the ability to sift through vast information faster than humans alone. However, it is no magic wand. Its limitations — overfitting, regime shifts, execution frictions, explainability challenges — demand that users remain vigilant, skeptical, and adaptive.

To succeed with 5starsstocks.com ai, begin slowly, combine AI signals with your judgment, monitor performance, and never forget that in investing, tools amplify, not replace, human reasoning. Treat it as a partner in your journey, not a master of fate.

Music8 months ago

Music8 months ago[Album] 安室奈美恵 – Finally (2017.11.08/MP3+Flac/RAR)

Music8 months ago

Music8 months ago[Album] 小田和正 – 自己ベスト-2 (2007.11.28/MP3/RAR)

- Music8 months ago

[Single] tuki. – 晩餐歌 (2023.09.29/Flac/RAR)

- Music8 months ago

[Album] back number – ユーモア (2023.01.17/MP3/RAR)

Music8 months ago

Music8 months ago[Album] 米津玄師 – Lost Corner (2024.08.21/MP3 + Flac/RAR)

- Music8 months ago

[Single] ヨルシカ – 晴る (2024.01.05/MP3 + Hi-Res FLAC/RAR)

Music8 months ago

Music8 months ago[Album] ぼっち・ざ・ろっく!: 結束バンド – 結束バンド (2022.12.25/MP3/RAR)

Music8 months ago

Music8 months ago[Album] Taylor Swift – The Best (MP3 + FLAC/RAR)