Finance

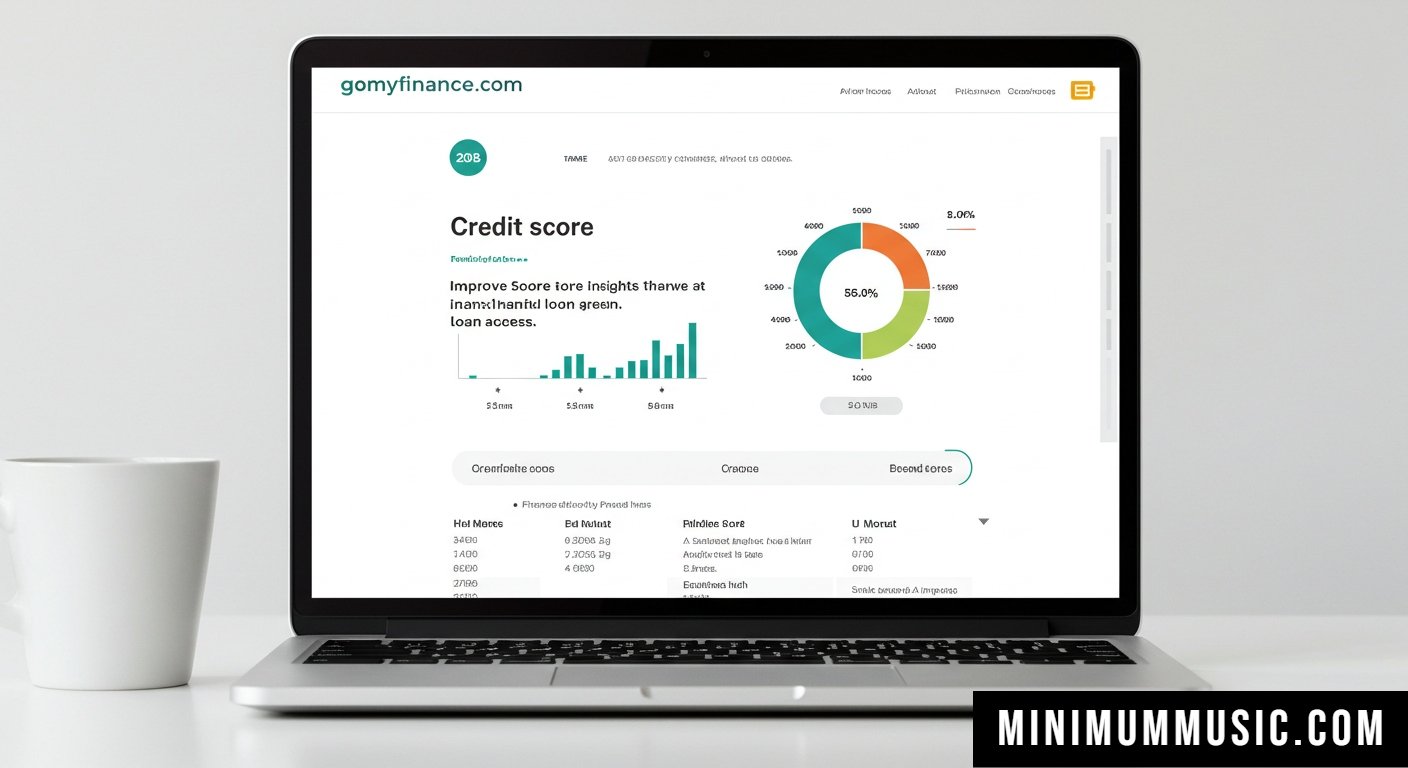

gomyfinance.com credit score: What You Need to Know

Introduction

Your credit score is like a financial report card. Lenders, landlords, and even employers may look at your credit score to decide whether to trust you with a loan, rent, or job offer. gomyfinance.com credit score aims to aggregate, analyze, and present credit information so users can understand their credit health clearly.

Many people think a credit score is just a number—and it is—but there’s much more behind it: what influences it, how often it changes, and how platforms like GoMyFinance present and interpret it. We’ll cover all that and also share strategies to get your score into a healthier range.

Let’s begin by exploring exactly what gomyfinance.com credit score means, how it’s generated, and who uses it.

What is gomyfinance.com credit score?

When you hear “credit score,” that’s a general term. “gomyfinance.com credit score” refers specifically to the score or credit assessment provided via GoMyFinance’s platform—whether it’s their own algorithm, aggregated from external credit agencies, or a blended metric.

GoMyFinance might fetch data from credit bureaus, combine that with your account usage, debt ratios, payment history, and then generate a score to help you see where you stand. It offers users a window into how lenders might view them.

Key features of gomyfinance.com credit score include:

- Credit data aggregation: It brings together information about your credit accounts, loans, credit cards, and payment history.

- Scoring algorithm: It likely uses weighted factors like payment reliability, outstanding balances, length of credit history, new credit, and credit mix.

- Visual tools and trends: Charts, trend lines, alerts, and breakdowns help you interpret your score over time.

- Recommendations: Based on your score, they may offer suggestions to improve it.

By using gomyfinance.com credit score, you gain better visibility into your credit health than relying on fragmented sources or guesses.

Why gomyfinance.com credit score matters

Credit scores are not just for people borrowing money. They influence:

- Loan interest rates: A better credit score often means lower interest on mortgages, auto loans, and personal loans.

- Approval odds: Lenders may reject you if your credit score is too low.

- Insurance premiums: Insurers in some regions use credit scores to price coverage.

- Renting and deposits: Landlords or utility companies might check your credit to determine whether to accept you or demand a deposit.

- Identity and fraud alerts: Platforms like GoMyFinance may warn you when major changes happen in your credit file.

Thus, gomyfinance.com credit score isn’t just a number you glance at—it’s a tool that can affect many financial aspects of your life.

You May Also Like: 5starsstocks.com ai

How is credit score calculated?

While GoMyFinance may not publicly reveal its full formula, credit scoring generally includes:

- Payment history (≈35%)

Late payments, defaults, or gaps in payments hurt your score the most. - Amounts owed / credit utilization (≈30%)

The ratio of balances to limits—keeping utilization low helps. - Length of credit history (≈15%)

The older your accounts and credit lines, the better. - New credit inquiries (≈10%)

Opening many new accounts or hard inquiries in a short time can reduce your score. - Credit mix (≈10%)

Having a healthy mix—credit cards, loan types—may help.

GoMyFinance may also include supplemental factors:

- Trends over time: whether your balances and payments are improving or worsening.

- Behavioral data: e.g. how often you log in, pay early, or set alerts.

- Alerts or negative flags: recent defaults, bankruptcies, or public records.

Thus, gomyfinance.com credit score is likely dynamic and responds to changes you make.

How to check your credit score

To view your gomyfinance.com credit score, you generally follow these steps:

- Sign up or log into GoMyFinance (using email, phone, or credentials).

- Grant necessary permissions to fetch your credit data—this may involve identity verification.

- Navigate to the “Credit Score” or “Credit Health” section.

- You’ll see your numeric score, along with a breakdown of contributing factors (payment history, utilization, alerts).

- Many platforms also allow you to see trends—past scores, alerts, monthly changes.

Some tips:

- Ensure your personal data (name, ID) matches your credit file so that GoMyFinance can fetch accurate data.

- Use strong authentication to protect your account.

- Check periodically (monthly or quarterly) to track progress.

What is a “good” credit score?

Credit score ranges differ by country and system, but a common scale is 300–850 (or 0–1000 in some locales). For gomyfinance.com credit score, a “good” score likely falls in the above-average bracket.

Below is an approximate classification (you’ll need to check GoMyFinance’s definitions):

Range | Interpretation |

| Top score (e.g. 750+) | Excellent credit — lenders offer best rates |

| Mid-high (e.g. 700–749) | Very good — minor risk, favorable offers |

| Mid (e.g. 650–699) | Good — acceptable to many lenders |

| Below mid (e.g. 600–649) | Fair – might pay higher rates |

| Low (under 600) | Poor – limited access, high interest, rejection risk |

If GoMyFinance uses a 0–1000 scale, then proportionately 800–900+ would be excellent, etc.

Your goal is to push your score into “very good” or “excellent.” Monitoring gomyfinance.com credit score can show you where you stand now and how far you need to go.

Factors that hurt your credit score

To improve, you need to know what drags it down. Common issues:

- Missed or late payments

- High credit utilization (using most of your credit limit)

- Frequent hard inquiries / new accounts

- Short credit history / closing old accounts

- Default, collection, bankruptcy, public records

- Too few accounts or lack of credit mix

- Identity mismatches / inaccurate data

If gomyfinance.com credit score shows alerts, investigate each negative mark and correct errors via dispute.

Strategies to improve your credit score

Improving your credit score is achievable. Here are actionable steps:

- Pay on time, every time — establish automatic payments

- Reduce credit card balances — aim for utilization < 30% (or lower, e.g. <10%)

- Don’t open too many new accounts quickly

- Keep older accounts open — credit age matters

- Diversify your credit — try mix (credit card, installment loan, etc.)

- Check for errors and dispute them

- Set reminders or alerts — GoMyFinance may help here

- Negotiate with creditors — settle old debts or arrange payment plans

- Use short-term earned credit boost tools (if GoMyFinance offers them)

- Limit hard inquiries — avoid applying for multiple credit lines in short times

Over months or years, consistent actions lead to measurable improvements in gomyfinance.com credit score.

How often does gomyfinance.com update the credit score?

Score updates depend on:

- Data refresh frequency from credit bureaus (e.g. monthly)

- When your new payments or credit events post

- When your balances change

- Platform policies (GoMyFinance may fetch fresh data nightly, weekly, or monthly)

Often, your gomyfinance.com credit score will update monthly, though some changes (big payments, new defaults) can show sooner. Always check the “Last Updated” timestamp.

Reading the gomyfinance.com credit score dashboard

In the dashboard, you may see:

- Your current score

- A color band (red = poor, yellow = fair, green = good/excellent)

- Trend graph (past 6–12 months)

- Breakdown by factors (payment, utilization, length, inquiries, alerts)

- Actionable tips (e.g. “Pay down card A by 20%”)

- Alerts or warnings

- Simulators (“What if you paid off a loan?”)

Use those visuals to understand which lever you need to pull to improve your gomyfinance.com credit score.

Comparisons: gomyfinance.com credit score vs other systems

You might wonder how gomyfinance.com credit score stacks up against:

- FICO (used widely in USA)

- VantageScore

- Local/national credit bureau scores

Differences include:

- Scale differences: ranges may differ (300–850, 0–1000, etc.)

- Weighting: GoMyFinance may include extra behavioral or aggregated data

- Refresh frequency

- Transparency: third-party systems sometimes share weight percentages, which platforms might not

Thus, your GoMyFinance score may be higher or lower than your FICO or bureau score—but the trends matter most.

Common misconceptions about gomyfinance.com credit score

- “It’s fixed, I can’t change it.”

Wrong—credit scores evolve with your behavior. - “More credit is always better.”

No—too much unused credit or too many new accounts can be harmful. - “Closing an old account boosts score.”

Not always—in many cases closing old accounts shortens credit history, hurting the score. - “Soft checks lower my score.”

Usually not—GoMyFinance may use soft checks; hard inquiries are the ones that matter. - “One late payment ruins everything forever.”

A single late mark hurts, but good behavior afterward helps you recover.

Understanding these helps you use gomyfinance.com credit score wisely, without falling for myths.

Risks and limitations of gomyfinance.com credit score

While helpful, there are caveats:

- Data delays or inaccuracies

If sources are slow or incorrect, your score may lag or be wrong. - Lack of full transparency

You may not know exact weightings of factors used in GoMyFinance’s algorithm. - Overreliance

The GoMyFinance score is a guide—not the only metric lenders use. - Regional differences

Credit scoring factors vary by country and credit system—GoMyFinance may not reflect all local nuances. - Security and privacy

Sharing credit data always carries some risk. Ensure GoMyFinance has strong security.

Given all this, use gomyfinance.com credit score as one tool among many—not the absolute truth.

How to interpret fluctuations in gomyfinance.com credit score

Sometimes your score may fluctuate, even if you’ve done nothing drastic. Here’s why:

- Credit card statements close: high balances before closing day can temporarily raise utilization.

- New inquiries: applying new credit lines can dip your score.

- Credit agencies update late: delayed or late reporting can shift your score.

- Errors: incorrect or fraudulent accounts may appear.

- Small changes in balance or payment timing can move your score a few points.

Don’t panic at small dips. Look for trends (negative or positive) over months—not day to day.

Integrating gomyfinance.com credit score into financial planning

Your gomyfinance.com credit score should play a role in your financial plan:

- Before applying for large loans or mortgages, check your score—and improve beforehand.

- Use the score dashboard to project when you can safely borrow.

- Tie score improvement goals to broader goals like buying a home, car, or funding business.

- Monitor quarterly for identity theft or unexpected changes.

- Use alerts (if GoMyFinance offers them) to notify you when key metrics change.

Thus, your credit score doesn’t exist in isolation—it supports your entire financial journey.

Features to expect from gomyfinance.com credit score platform

If you use their credit score feature, ideal supporting features could include:

- Alerts and notifications (e.g. sudden drops, new accounts)

- “What-if” simulators (e.g. “if I pay $500 off, how much will my score increase?”)

- Credit improvement plans tailored to your situation

- Educational material and tips

- Comparisons against peers or benchmarks

- Security features, e.g. two-factor authentication

- Historical/archive access to see your credit journey

- Dispute or correction tools (or at least links to bureaus)

When GoMyFinance offers these, gomyfinance.com credit score becomes more than a number—it becomes a full toolkit.

Security, privacy, and data concerns with gomyfinance.com

Given that credit profiles are sensitive:

- Ensure data is encrypted in transit (HTTPS, SSL) and at rest

- Use strong authentication (two factor where possible)

- Read privacy policy: how long do they store your data?

- Check whether they share data with third parties

- Use unique, strong passwords

- Monitor for unauthorized access or alerts

- Prefer platforms that allow you to delete or freeze your data if needed

By staying vigilant, you can use gomyfinance.com credit score without exposing yourself.

Tips for maintaining a strong gomyfinance.com credit score long term

- Continue paying bills early or on time

- Keep balances low relative to limits

- Avoid frequent applications for new credit

- Keep old accounts open (if no fee)

- Monitor credit reports annually for errors

- Stay diversified (but don’t overextend)

- Use emergency funds, not credit, for surprises

- Review your gomyfinance.com credit score regularly for changes

Consistency over months and years compounds into strong credit health.

Troubleshooting: What to do if your gomyfinance.com credit score suddenly drops

- Check for alerts or notices in your GoMyFinance dashboard.

- Verify that new accounts or inquiries haven’t been added without your knowledge.

- Check your latest statements—did you miss something?

- Look for identity theft or fraud.

- Dispute errors with credit bureaus / with GoMyFinance.

- Slow down new credit applications.

- Pay down any spikes in utilization.

- Monitor to see whether the drop was temporary (e.g. reporting lag) or real.

Over time, corrective actions help restore your credit score.

When should you worry about your gomyfinance.com credit score?

You should pay close attention when:

- Your score is declining month after month

- You receive alerts for new accounts or defaults

- You plan to borrow a large sum (mortgage, big business loan)

- You are denied credit or offered high interest

- You see unfamiliar accounts or identity theft signs

If any of these show, act quickly to protect and repair your credit.

Alternative credit scoring tools vs gomyfinance.com credit score

While GoMyFinance offers one approach, you might also check:

- National or local credit bureau scores

- FICO or VantageScore (if available in your region)

- Bank or lender’s internal credit scoring

- Nontraditional scoring (e.g. utility payments, rent, subscription payments)

Comparing them helps you see how gomyfinance.com credit score aligns or diverges—and gives you a fuller picture.

Legal and regulatory aspects affecting gomyfinance.com credit score

Depending on your country:

- You may have rights to access your credit file or dispute errors

- Laws regulate how long negative marks (collections, bankruptcies) can stay

- Data protection laws govern how platforms like GoMyFinance handle personal data

- Lenders must follow fair lending rules; they can’t discriminate unfairly based on credit scoring

Understanding your legal rights ensures you can challenge incorrect entries on your gomyfinance.com credit score file.

Potential future trends for gomyfinance.com credit score

- Incorporating alternative data (utilities, rent, mobile phone payments)

- Using machine learning to better predict creditworthiness

- Real-time or near real-time updates

- Integration with budgeting or financial planning tools

- Personalized credit coaching built directly in the platform

- Deeper simulation engines (e.g. “if I pay off this, what’s the effect?”)

As platforms evolve, gomyfinance.com credit score may become more predictive, nuanced, and actionable than ever.

Conclusion

Your gomyfinance.com credit score is more than just a number—it’s a window into how lenders, landlords, and others might view your financial reliability. By understanding how it’s calculated, what causes it to rise or fall, and how to interpret its trends, you can use it as a powerful tool in your financial journey.

Start by regularly checking your score, then implement the strategies we discussed: paying on time, reducing balances, avoiding unnecessary new credit, and disputing errors. Over time, positive habits will yield stronger credit health and unlock better opportunities for you.

Be patient, be consistent, and consider your score a long-term partner—not something that changes overnight. The road to credit confidence is gradual, but gomyfinance.com credit score can guide you step by step to where you want to be.

Music8 months ago

Music8 months ago[Album] 安室奈美恵 – Finally (2017.11.08/MP3+Flac/RAR)

Music8 months ago

Music8 months ago[Album] 小田和正 – 自己ベスト-2 (2007.11.28/MP3/RAR)

- Music8 months ago

[Single] tuki. – 晩餐歌 (2023.09.29/Flac/RAR)

- Music8 months ago

[Album] back number – ユーモア (2023.01.17/MP3/RAR)

Music8 months ago

Music8 months ago[Album] 米津玄師 – Lost Corner (2024.08.21/MP3 + Flac/RAR)

- Music8 months ago

[Single] ヨルシカ – 晴る (2024.01.05/MP3 + Hi-Res FLAC/RAR)

Music8 months ago

Music8 months ago[Album] ぼっち・ざ・ろっく!: 結束バンド – 結束バンド (2022.12.25/MP3/RAR)

Music8 months ago

Music8 months ago[Album] Taylor Swift – The Best (MP3 + FLAC/RAR)